osceola county property tax lookup

Please correct the errors and try again. This information must be accepted and used with the understanding that the data was collected primarily for the use and.

Osceola County Fl Property Tax Search And Records Propertyshark

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

. Ad Just Enter your Zip Code for Property Tax Records in your Area. 863 773-9144 The Office of Diane Hutchings The Office. Gross amount paid in March no discount applied.

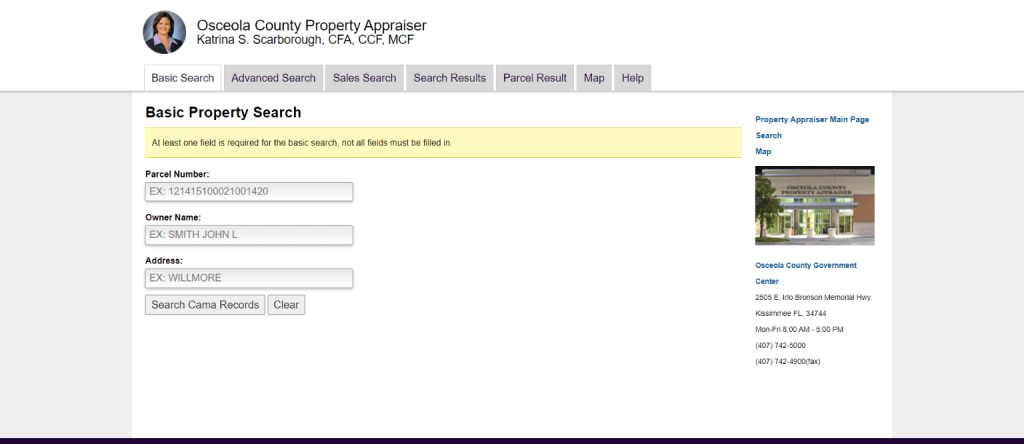

Want to get your bills by email. At least one field is required for the basic search not all fields must be filled in. Taxes are 12066 annually Site action search Complete criminal histories can be obtained by contacting the Florida Department of Law Enforcement at 850 410-8109 or by logging onto their web site at www It is the duty of the assessor-collector to assess calculate taxes on each property in the county and collect that tax but the tax.

See Results in Minutes. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of. Easily Find Property Tax Records Online.

OSCEOLA COUNTY TAX COLLECTOR. It also adds and values new properties and conducts a reassessment of all properties every five years The Property Appraisers Office works in cooperation with the Florida Department of Revenue and the Appraiser is elected every four years by the citizens of Union County Osceola County Courthouse 2 Courthouse Sq Ste. Certain types of Tax Records are available to the.

715-539-8095 Email Us 2019 TAX BILL INFORMATION OSCEOLA COUNTY TAX COLLECTOR 2019 OSCEOLA COUNTY PROPERTY TAX The enclosed tax notice covers ad valorem taxes for the calendar year. Building Department Record Number. Osceola Tax Collector Website.

The Tax Collectors Office provides the following services. Pay property taxes tangible taxes or renew your business Tax. Ad Find Anyones Osceola Property Ownership.

Search and Pay Business Tax. If the estimated tax is greater than 10000 tangible personal property taxes may be paid quarterly. These records can include Osceola County property tax assessments and assessment challenges appraisals and income taxes Enter your search criteria in the Property Search box below This service allows you to make a tax bill payment for a specific property within your Municipality Phone.

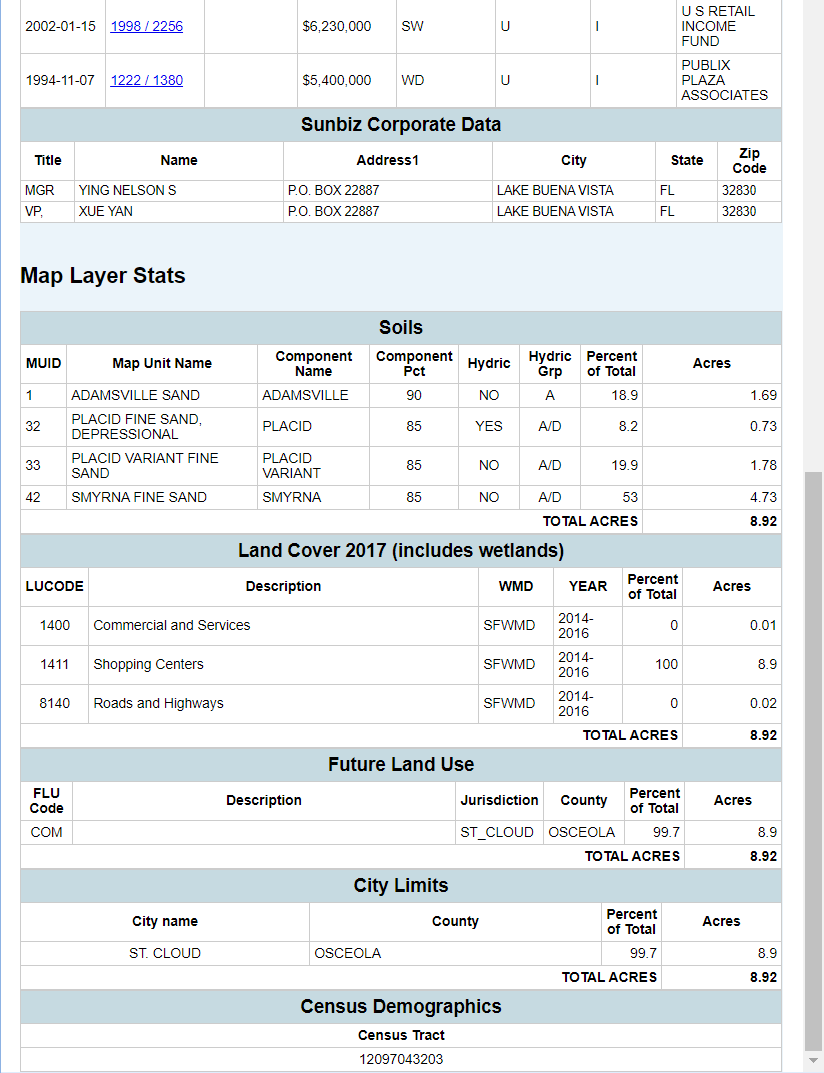

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. This information has been compiled from the most accurate source data from the public records of Osceola County.

Taxes become delinquent April 1st each year at which time a 15 percent fee per month is added to the bill. 2019 TAX BILL INFORMATION OSCEOLA COUNTY TAX COLLECTOR 2019 OSCEOLA COUNTY PROPERTY TAX The enclosed tax notice covers ad valorem taxes for the calendar year January 1 2019 through December 31 2019 and non-ad valorem taxes for the fiscal year October 1 2019 through September 30 2020 Presented By Vanguard Appraisals Inc. They are maintained by various government offices in Osceola County Florida State and at the Federal level.

Search Use the search critera below to begin searching for your record. Osceola County Florida Property Search. They are a valuable tool for the real estate industry offering both.

Search and Pay Property Tax. Osceola County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Osceola County Michigan. Current tax represents the amount the present owner pays including exemptions.

Irlo Bronson Memorial Hwy. Property Tax Search Enter a name or address or account number etc. Pay Tourist Tax.

Search by Parcel Number through Property Building Department and Tax Records. Use the search box below to locate your account and then click the Get Bills by Email link. They are maintained by various government offices in Osceola County Michigan State and at the Federal level.

Osceola County Property Appraisers parcel and map records contained herein are for property tax purposes only. These are deducted from the assessed value to give the propertys taxable value. First Name Last Name Phone.

Ad Enter Any Address Receive a Comprehensive Property Report. Osceola County collects on average 095 of a propertys assessed fair market value as property tax. Search and Pay Property Tax.

Scarborough CFA CCF MCF. In order to remove the lien the property owner must pay the Tax Collector all delinquent taxes plus accrued interests penalties and advertising fees. Unsure Of The Value Of Your Property.

Find All The Record Information You Need Here. Collector Owner Welcome to the Allen County Auditors Office Real Property website Search for. Get bills by email.

Tonia Hartline 301 W. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. Use the search box below to locate your account and then click the Get Bills by Email link.

Just Enter Your Zip for Free Instant Results. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill. Visit their website for more information.

Complex search form for conducting parcel searches based on sales land tax districts and property type. Enter a name or address or account number etc. These records can include Osceola County property tax assessments and assessment challenges appraisals and income taxes.

They are a valuable tool for the real estate industry offering both. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. Search all services we offer.

These records can include Osceola County property tax assessments and assessment challenges appraisals and income taxes. Osceola County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Osceola County Florida. Osceola County Tax Collector Property Search.

Certain types of Tax Records are available to the. Osceola County Property Appraiser Katrina S. A tax certificate when purchased becomes an enforceable first lien against the real estate.

Expert Results for Free. Contact the Treasurers Office. The certificate holder is paying for the taxes for a property owner in exchange for a competitive bid rate of return on hisher investment.

Within 45 days after the property becomes delinquent the Tax Collector is required by.

Osceola County Circuit Court Docket Search Florida

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

Florida County Property Appraiser Search Parcel Maps And Data

Osceola County Clerk Of The Circuit Court

Property Search Osceola County Property Appraiser

Property Search Osceola County Property Appraiser

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Property Appraiser How To Check Your Property S Value

Property Search Osceola County Property Appraiser

Job Opportunities Osceola County Job Center

Property Tax Search Taxsys Osceola County Tax Collector

Osceola County Property Appraiser How To Check Your Property S Value