georgia property tax exemptions for veterans

Pursuant to Senate Bill 415 effective November 1 2021 all new applicants for sales tax exemption based on a veterans 100 service-connected disability status are required to register in the Oklahoma Veterans Registry to verify eligibility. If you think you qualify you must apply for exemptions through the Tarrant Appraisal District the exemption will not be granted automatically.

18 8 Property Tax Exemptions In Georgia Georgia Real Estate License Realestateu Tv Youtube

The home must be your primary residence.

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

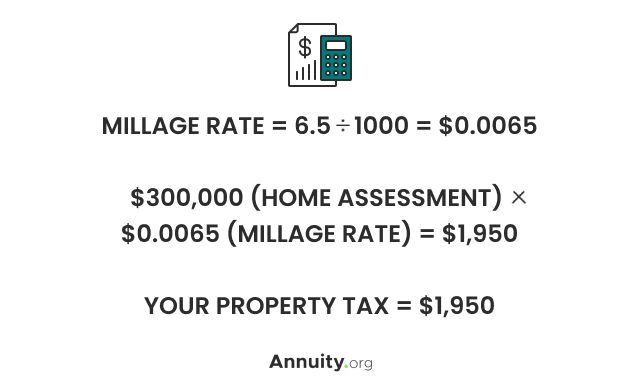

. Homestead is the debtors primary residence situated on up to 12 acre in a city and 160 contiguous acres in an unincorporated county. In Georgia the median property tax rate is 907 per 100000 of assessed. Veterans and surviving spouses previously awarded sales tax exempt status prior to November 1 2021 must register in the.

Georgia Real Property Taxes. Georgia offers special benefits for Service members Veterans and their Families including property tax exemptions state employment preferences education and tuition assistance free drivers licenses vehicle tags nursing home care for war Veterans as well as hunting and fishing license. Valid Georgia insurance electronically submitted into the Georgia Insurance Database or an insurance binder or declarations page less than 30 days old.

Piedmont Avenue Rockmart Georgia 30153 Phone. Special exemptions are available for citizens 62 years of age and older disabled veterans and other disabled residents. If your 45-day Georgia temporary permit is due to expire please contact our call center at 404-298-4000 for additional information or visit our office with your bill of sale.

Local state and federal government websites often end in gov. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes. Application must be filed electronically through the Georgia Tax Center.

Unfortunately too many of these breaks are poorly. Retirees over 65 get a tax exemption for the first 150000 of their houses value. To receive any Exemptions you must apply in person at the Tax Assessors Office located at 2782 Marietta Hwy Suite 200 Canton GA 30114.

The drivers license must also reflect the property address for which you are claiming the homestead exemption. The most common Florida bankruptcy exemptions in 2022 include. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of median property taxes.

The gov means its official. Mission Statement The mission of the Department of Revenue is to administer the tax laws of the State of Georgia fairly and efficiently in order to promote. Unless you live in states with low property taxes such as Alabama Hawaii and West Virginia you may need help covering your tax bills.

States With No Property Tax For Seniors After Age 65. State governments provide a wide array of tax breaks for their elderly residents. Choose from hundreds of different plate designs including veterans colleges special interest groups.

Brevard County Property Appraiser - Property Tax Exemptions. Exempt from state tax but local taxes may apply. Requirements for all exemptions.

State of Georgia government websites and email systems use. Maine joins six states including Connecticut New Jersey and Rhode Island that offer tax freezes for elderly homeowners according to the National Conference of State Legislatures. Senior School Property Tax Relief.

Alaska also offers money to people who live here which may balance out any additional taxes you have. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. Amanda Lindsey 144 West Avenue Suite A Cedartown Georgia 30125 Phone.

Veterans with disabilities may also qualify for property tax exemptions. If you or your loved one is a veteran you may qualify for a partial or full property tax exemption. Our breakdown of veterans property tax.

Property Tax Homestead Exemptions. Exemptions Granted by Board of Tax Assessors. Paying your property taxes is no easy feat.

To be clear property tax exemptions dont let you off the hook completely. Real Property Exemptions - Effective July 12008 may apply at anytime prior to April 1st of effective year. West Virginia voters will consider a constitutional amendment that would allow the legislature to approve exemptions to personal property taxes on property used for business such as machinery equipment and inventory and to exempt personal motor vehicle property tax from ad valorem.

Veterans Property Tax Exemption. GDVS personnel will assist veterans in obtaining the necessary documentation for filing. Additional exemptions based on income and disability.

A Rundown on Veterans Property Tax Exemptions by State. Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. A copy of your Georgia drivers license showing you are a permanent and legal resident of both Cobb County and the state of Georgia.

The general rule for all exemptions is. Another 10 states have tax assessment freezes for seniors veterans and disabled homeowners that keep their property taxes from increasing the group says. Fulton County collects on average 108 of a propertys assessed fair market value as property tax.

In order to qualify for homestead exemptions you must provide proof of the following. Armed forces vets with a total disability and veterans with service-connected. 770 749-2149 316 N.

Examples of senior property tax exemptions by state. Almost every state that levies an income tax allows some form of income tax exemption or credit for citizens over age 65 that is unavailable to non-elderly taxpayers. Property and services are used exclusively in performing a general treatment function when such clinic is a tax exempt entity under the Internal Revenue Code and obtains an exemption determination letter from the Commissioner.

Most states also provide special property tax breaks to the elderly. Veterans organizations Historical fraternal-benefit associations chartered prior to January. Contact Information Tax Commissioner.

Qualifying seniors 65 and older can get 50 up to 400 credit against school property tax for their primary residence. Instead they exempt a certain portion of the. Local Government Services.

The actual filing of documents is the veterans responsibility. Bankruptcy law imposes limits on the homestead exemption that are not applicable under state law. Applicants for senior or disability exemptions must apply in person and present copies of the previous years federal and state income tax returns any Social Security Form 1099s proof of age andor proof of 100 percent.

Summary of Georgia Military and Veterans Benefits. Qualifying veterans can get a 1500 property tax exemption. This state offers a full exemption for retirees over 65 when it comes to state property taxes.

The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. Applications can be filed year round but must be submitted on or before April 1st in order to apply for the current tax year.

States With Property Tax Exemptions For Veterans R Veterans

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

The Ultimate Guide To North Carolina Property Taxes

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

I Also Have Friends Who Dont Have To Pay Property Tax After Getting Medical Disability Does Fox News Want This To Go Away R Military

Property Taxes By State In 2022 A Complete Rundown

What Is A Homestead Exemption And How Does It Work Lendingtree

Find Out If There Are Any States With No Property Tax In 2020 Which States Have The Lowest Property Taxes States Property Tax Property Real Estate Investor

Veteran Tax Exemptions By State

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

Are There Any States With No Property Tax In 2021 Free Investor Guide Retirement Money Social Security Benefits Retirement Retirement Advice

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans